For weeks 1-10′s recap, please click “Sales Challenge” under Categories. My goal is to hit $80k in 5 months (20 weeks). Results are at the bottom on this post.

The point of the sales challenge and recapping my apps for the week are for training purposes.

For those that subscribe to my newsletter, you received an email about the life insurance movement. Thanks to those who took part. You supported a great cause and will get some back links coming from some authority websites shortly.

On top of my production this week, I’m working on 2 new term conversion opportunities. The first one is 62 years old and has a Genworth policy expiring in 2 years that he wants to convert $200,000 into a permanent life policy with cash value. I gave him a ballpark figure for numbers and he seemed fine with them, so I asked him to sign a BOR change letter requesting to change the agent of his policy to me. He faxed it right back and it will take a couple weeks before it’s acknowledged and I can get access to his options. The other conversion opportunity is 4 years into his 10 year term with Banner Life and wants to convert a portion of his policy. We went over his options and he’s going to check with his financial adviser to make sure it’s the right move (I asked if his FA sells insurance and he doesn’t..whew!).

This week I submitted 6 EZlife applications, 3 Fidelity Applications and 1 United Home Life Application.

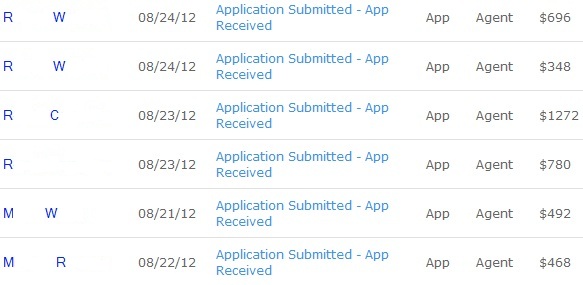

Lets start with the 6 EZlife apps for a total of $4056 submitted (dashboard screenshot below with names whited out):

EZlife App #1 and #2 : Website lead. He was declined by Fidelity from another agent because of his MVR. His ex-wife had a DUI in his car and they had a device installed in it. It’s showing up in his MVR report when it wasn’t him who had the DUI. He’s working on getting it removed. I drafted a cover letter explaining everything. We applied for 2 different policies using a “laddering” strategy. App Out $1044 total.

EZlife App #3: Website lead. He’s a federal employee and FEGLI rates were more expensive and rising every 5 years. I saved him about 25% and kept it level for 20 years. He’s a type 2 diabetic, a1c’s below 7 and diagnosed at age 55. He also has a degenerative disc disease, but ref’s high school football games in his retirement and doesn’t take any meds so it shouldn’t be too big of an issue. He received quotes from MetLife and PRU at Table 2 rates. I was going to quote a conservative Table 4 rate until he told me his other quotes, so I quoted Protective Table 2 and told him there’s a chance it could come back Table 4 and he was ok with those rates as well. App out $1272

EZlife App #4: Referral. No health issues, should be an easy approval. App out $780

EZlife App #5: Website Lead. Her policy is expiring next month and she wanted a no-exam policy for $100k. Unfortunately she couldn’t qualify for Fidelity, Assurity or Americo non-med term because of some depression and anxiety meds she was on. We ended applying for Transamerica 20 yr term at $95,000 of coverage so she didn’t have to take the exam (just APS). It’s more expensive and she realizes it, but it’s still a lot less than what she’ll be paying next month without the hassle of taking an exam. App out $492

EZlife App #6: Referral. She had a kidney rupture and removal back in January of 2004. Everything has been fine since. She needs this coverage for a loan and would pay “anything” to get it (I love when people say that). I don’t think she’ll have a problem getting coverage, but I quoted her Table 2. App out $486

United Home Life Application: This guy is a Type 1 diabetic w a1c’s in the 8.8-9.1 range. He was turned down by ING and MetLife over the past 3 years. He needs $350,000 of coverage to fulfill his obligation in his divorce decree and it’s come to the point where the judge is threatening incarceration because he doesn’t have the life insurance after 3 years. UHL is the only option I have for him right now for $50k of whole life. He wants to show good faith and at least get something in force. I told him I’d write a letter letting the judge know he can’t qualify for the amount based on his health. App out $1392

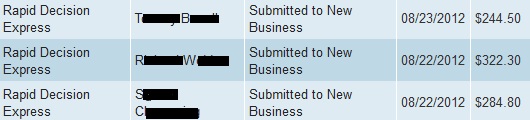

Fidelity Apps: 3 applications for $851.60. These were all referrals that needed coverage quickly for a loan.

All in all, I had a pretty good week. 10 applications for around 20-25 hours of actual sales time – pretty good volume. My average premiums have been low because of this referral source. However, they are slam dunk new clients and I don’t have to spend much time with them so they’re worth it.

Total premium apped out over week 11: $6300

Total premium to date (over 11 weeks): $68,362

Someone asked me this week why I chose a 5 month challenge and why I chose $80k, since they both seem to be odd numbers. Well, the 5 months would put me in the beginning of November as an end date and we’re expecting our first child early December so I didn’t want the challenge to overlap with our baby coming. The $80k goal was taken from working the numbers backwards from making $100k per year. Submitting $4k per week or $16k per month would put me at $80k over 5 months. Assuming 55% place, that’s $8,800 in placed premium per month which equates to over $100k per year in commissions.

I’m almost there! Less than $12k more to go.