For weeks 1-4’s recap, please click “Sales Challenge” under Categories.

The point of recapping my apps for the week are for training purposes.

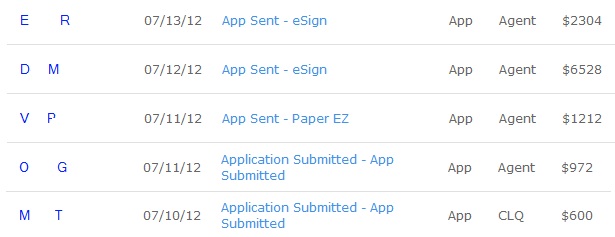

I had a GREAT week. 5 EZlife applications and 5 Fidelity Life Applications. Lets start with the 5 EZlife applications. Summary is below with names whited out.

EZlife App #1: Website lead who had FEGLI (Federal Employees Group Life Insurance) and is retiring at the end of August. With FEGLI you can take your group life insurance with you at retirement but it’s expensive and it goes up every 5 years. He still wanted to carry $250,000 of coverage for his wife. This guy had a squeaky clean health history but he was just diagnosed with Type 2 diabetes last year at age 60. His a1c’s have never been above 7.0 and he takes Glucophage. With controlled diabetes diagnosed over age 60 and in good health otherwise can qualify for Standard rates with several carriers. We ended up going with a 20 year term with Protective Life. This was still almost half the cost of what his FEGLI option was. App out for $2304

EZlife App #2: Website lead who in my week 1 sales challenge I mentioned I quoted a $10k case. This was that case, but instead of $200k, we went with $100k of coverage. This guy has COPD and still smokes. He was declined by American General a couple months ago. He realizes it’s not a good combo (COPD + Smoking), but just can’t seem to kick his smoking habit. I’ve successfully underwritten COPD cases before and knew the questions to ask, including his most recent FEV which was 59%. I quick quoted it out to 8 carriers – 5 declined and 3 gave tentative offers. Those 3 were Prudential (Table 4), Lincoln Financial (Table 10) and MetLife (Table 6). It’s crazy to me that these companies would even write coverage for this risk. We wrote the app with Prudential. App out $6528

EZlife App#3: Website lead who smokes pot and in all other aspects is a healthy physical therapist. The key with marijuana underwriting is how often do they smoke. This guy smokes 1-2 times per week and can qualify for NON-SMOKER rates with Lincoln Financial. A few other carriers will go non-smoker, but you have to test negative for THC, so I don’t take the risk and just go with the sure shot in Lincoln Financial. App out $1212

EZlife App #4: Referral who needs the coverage for a loan. This guy is 5’9 325 lbs and had a defibrillator. According to XRAE, PRU, Protective and Met were the only ones who would offer him coverage based on his build. Pru had the lowest table rating at Table 3. I added another 3 tables for his defibrillator and we applied at a Table 6, but he will take a Table 8 if it’s offered. App out for $972

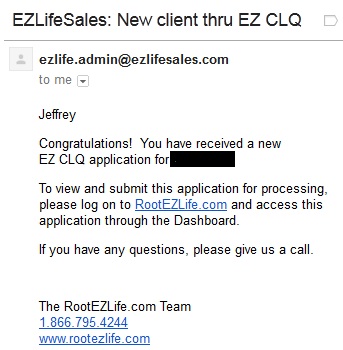

EZlife App #5: This was a website lead where he actually requested an application through my instant quoter that comes free with EZlife. Those are great emails to get overnight!

He applied for preferred plus rates with SBLI and I called him to confirm that he’s healthy and he was. I transferred it to the EZlife team to complete the medical exam and get the e-signature. Probably the easiest application I’ve taken in my entire life. Thank you inbound marketing efforts. App out $600

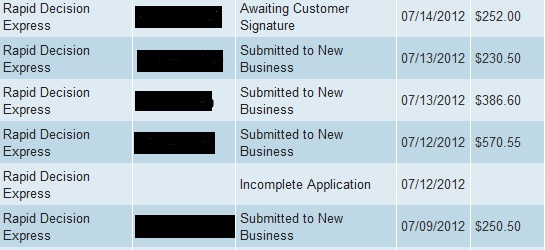

My 5 Fidelity Applications were referrals. So far 2 have been approved, 2 are pending decisions and 1 is pending their signature (they didn’t have access to their computer). I qualify these Fidelity applications HARD and I know their underwriting guidelines inside and out so when I take an application, I’d say 85%+ are approved.

It was a really good week sales wise. $11,616 submitted through EZlife and $1690.15 submitted to Fidelity.

Total premium apped out this week: $13,306

Total premium to date (over 5 weeks): $32,165

This week put me WAY ahead of pace to hit my 5 month goal of $80k submitted. I need to average $4,000 per week which would put me at $20,000 for this week to be on track. Being at $32,000 is a great start, but still have a long way to go.

2 Comments

Just wanted to drop a note and let you know you have a fan “root”-ing your way to $80k. 🙂

This site is a tremendous resource for any agent as I especially love hearing how you treat the different health conditions.

Keep up the good work!

P.S.

Awesome week!

Haha…Thanks for the support! I was beginning to think I was writing to myself!

And I’m glad you find value in the impaired risk area. I wish I had this sort of training when I was getting started, so I figured I’d make it available to other agents.