Sorry for the lack of updates recently. I’m expecting my first kid any day now and have been preparing for the arrival. I’ve been coming to the office fully prepared to leave for a few days. With that said, I’ve outsourced everything and am just taking inbound calls and marketing.

So lets do a quick “day in the life” of selling life insurance over the phone. The purpose of doing this is for training.

Summary of activity for my day:

- Called and emailed 2 lapse notices I received in the mail and got them back on track. (I really need to get someone else to handle these for me – will delegate that to a VA soon)

- Received 2 referrals that needed life insurance for a loan. I forwarded them to another agent whose handling them while I wait for my baby to come.

- Wrote a blog post on my website this morning.

- Was hoping to get access to Mutual of Omaha’s GI product (the lowest cost guaranteed issue life insurance on the market), but found out they’re only offering to big institutions like banks. It’s still only a direct product that independent agents can’t sell.

- Helped 2 agents with some hard to place cases.

I received delivery requirements on 2 cases today:

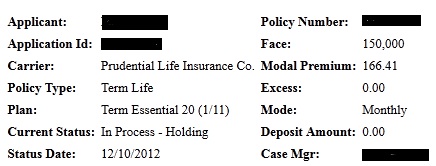

This guy actually applied at $200,000 20 year term for $102/mo. Ended up getting rated for abnormal EKG’s. However, his current term life insurance expired and he was paying the non-guaranteed $254/mo, so I recommended doing a 10 year term $150k to lower the rate to $166/mo – it was a no-brainer for him. I told him we can re-apply once he gets a few good EKG’s under his belt (That 20 year term on the image is wrong). This will definitely be a re-write for next year.

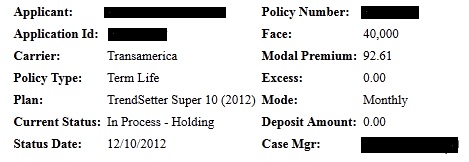

Placed Case #2: $1111 in AP

With this guy, I made the call that his policy was approved as applied for – he was happy to hear it. When EZlife mails policies out, they also email the delivery requirements. When he got his emailed delivery requirements, he immediately sent back his signed requirements and voided check within hours of that email going out (without receiving the policy). I love that EZlife does this!

I took 4 inbound calls from my website. Sold 2 of the 4. One of them was a husband/wife, so it was a total of 3 applications.

App #1 and #2: Husband and wife. Their Primerica policies expired and they called in for quotes. It was one of those calls where they want as much coverage as they can get for around $50/mo. I got them on a screenshare and was able to take their applications on the initial phone call. Neither of them had any health issues so it was easy. Easy $636 in AP

App #3: This guy took out a construction loan for $330k for his hotel. He already had the money and the bank overlooked the life insurance requirement. They are pressuring him to secure the coverage now. This guy is a cigarette and pot smoker. Cool story: He got divorced, retired from being a doctor and bought a campground/hotel and is running this as his retirement. Anyway – this was in NY so it limited my options. Ended up going with Banner (William Penn in NY) at Standard Smoker rates. I wrote a cover letter explaining his occasional usage and how he gets his weed (both important information for underwriters when there’s marijuana usage!). App out for $2056.

Pretty productive day overall. Whoever says December is slow for life insurance is just making excuses. However, it will obviously slow down around X-Mas and New Years – but it’s business as usual until then.