Update: There’s an ongoing thread with updates over here. Including proof of Ryan Pinney’s history of attempted/threat use of a dangerous weapon and being denied an insurance license back in 2004. And other proof that he doesn’t actually write any life insurance (no company appointments), yet he teaches others at Pinney Insurance and charges his own agent $2500 for his training.

If you’re thinking about doing business with Pinney Insurance or currently doing business with Pinney Insurance, BEWARE.

I’ve been struggling with the decision of if I should publish this or not and let everyone know what Pinney is doing to me (and many other agents) in addition to fighting this out in court.

I decided to publish this article because agents are still going to Pinney Insurance because of my legacy marketing and I don’t want any other agent to get screwed over by them like I was. This article serves the purpose of distancing myself from the Pinney Insurance organization and let everyone know exactly what happened.

Before I get into this, I have to say the employees at Pinney Insurance are awesome – any BGA would be lucky to have them and they keep Pinney Insurance afloat in my opinion. It’s the owners and executives who are dishonest and unethical for 2 key reasons:

(1) They don’t honor their contracts.

(2) They’ll make up reasons not to pay commissions.

I will go over both points in detail in the content below. I understand it’s libel if it isn’t true – I feel comfortable putting all of this out in the open for everyone to know because it’s fact based and I have evidence to back it up.

My History

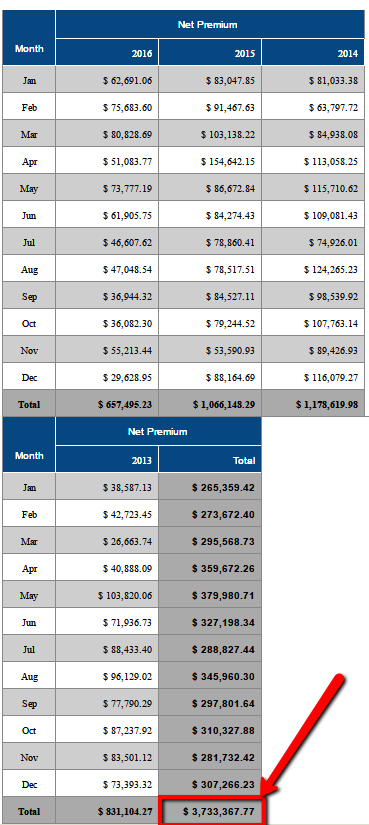

I’d like to first establish that I’m not just any agent who had a bad experience with them. I’ve worked with them closely since 2011 and have sent over $4mm in placed annual premium their way per the screenshot below (reporting only started in 2013):

Just so there’s no doubt I didn’t make these numbers up, here’s a screenshot from the actual system that shows Pinney Insurance branded and in the URL.

From 2011-2015, I promoted them heavily online and created a ton of goodwill for them over on the insurance-forums.net and from selltermlife.com.

Truth is they were fantastic from 2011 up until early 2015. In 2015, we noticed a steep decline in our applications submitted going in force. There were clear staffing and process issues that we continued to let Pinney know about. Nothing ever changed even though I was being told it would get better.

We went about a year with them under performing before I started taking my business elsewhere – but I still submitted a significant amount in 2016 as you can see above.

In the Fall of 2016 I started the process of building my own BGA because they continued to under perform. I was getting higher contracts than Pinney actually had (I gave them a shot and compared levels) and they couldn’t compete for my business – realizing that they were eventually going to lose me Ryan and Jan Pinney terminated me in January of 2017 and are keeping all my override commissions due to me – estimated over $40,000.

Their reasons for terminating me are:

(1) They accused me of cancelling contracts

First of all, I’m independent and can do whatever I want – so this in itself is a poor excuse. But I’ll explain anyway.

I notified them of contracts being cancelled and they were fine with it because I would keep sending them business. Which I did – in the 30 days prior to termination I had just 2 agents place $75,000 in placed premium and cumulatively I estimate close to $90,000 placed.

There were a couple contracts that I had to cancel in order to get BGA level contracts and I let them know and at the time they were fine with it – everything was disclosed and we were fine as long as business kept flowing their way. On 1 of those contracts I gave them the opportunity to get my business, but they were paid less than I was getting and the other contract was a specialty markets product where I had to cancel all my traditional brokerage contracts – I didn’t move it away from them, I cancelled it all together to get access.

In other words, Pinney was informed already of the cancelled contracts and was ok with it as long as I was still submitting business (which I was).

This was a made up excuse to terminate me.

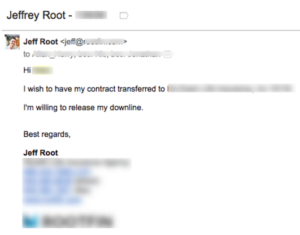

(2) Intentionally transferring hierarchies.

This is NOT true. They are referring to one instance where I needed to transfer a contract under another hierarchy in order to run a lead fulfillment deal. So I transferred that contract with Pinney’s knowledge and requested my entire hierarchy remain under Pinney Insurance. Here’s the email:

The carrier actually came back to me and said they have to transfer the entire hierarchy in order to make the move.

I never transferred any other hierarchies.

In other words, the reasons for termination were bogus. They made up their mind they wanted to terminate me to keep the money they owed me and came up with reasons.

I sent them a long email saying how wrong they were, but they didn’t care to even respond after 6 years of service to them and over $4mm of business sent through them.

After 2 weeks of no response, I was sent an email that they weren’t going to pay me the estimated $40,000 of commissions they owe me.

Not a phone call. An email that said my contract isn’t enforceable.

Pinney Insurance Does NOT Honor Their Contracts

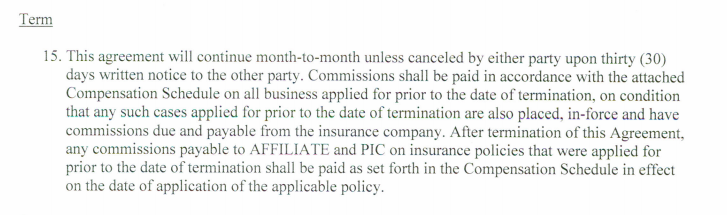

In 2011, I signed a contract with Pinney Insurance to recruit agents to Pinney Insurance. The contract states that upon termination of either party, Pinney Insurance will continue pay on any inforce business. Here’s an exact copy of the wording in my contract:

When Pinney terminated my contracts, I told them several times that I expected to be paid per section 15 of the contract. They ignored my repeated contact attempts to confirm I would be paid and I had to wait until the 1st of the month (2 weeks) to email accounting where they finally emailed me that they wouldn’t be paying me on the inforce business I sent their way.

Jan and Ryan Pinney didn’t have the courage to tell me until it was time to get paid around the 1st of the month…the same time I’ve been paid for 5+ years.

As of today, I haven’t received any of the inforce business commissions due to me. I’m filing a lawsuit to recover these commissions. The attorneys I’ve spoken with all tell me this is an enforceable contract especially since Pinney has acted according to the contract for 5+ years and the evidence is the EFT payments and monthly commission statements.

Keep in mind, Pinney Insurance will be getting paid as earned for 12 months on business I brought to them. Revenue they wouldn’t have without me.

It’s an absolute immoral and unethical move by Pinney Insurance.

They have a habit of not paying past employees and agents

I’m not the only person they’re taking commissions from. I know of at least 4 agents they’ve done this to and there are currently 3 other wage claims going through the legal process to collect on the compensation/commissions Pinney owes them.

A brokerage director I used to work closely with at Pinney Insurance was terminated in March of 2016, just before a very significant bonus payment was owed to him based on their agreement for inforce premium. Not only that, they called most carriers and told them never to work with him and tried to smear his name – the most vindictive move I’ve seen in this industry. They couldn’t just keep the compensation they owed him, they had to intentionally go out and affect his ability to earn a future income. There’s a hearing set this year for his wage claim.

They did this exact same thing and didn’t pay due commissions to a brokerage director in 2015 that were due to him. I don’t want to bring his name into this, but there’s a history of them doing this to their employees.

But it’s not just employees, they do this to their agents as well. In 2016, 2 call center agents quit and they didn’t pay the commissions on inforce policies they placed thru the last date of employment. Both agents have filed wage claims.

Again, I don’t want to bring any real names into the mix but I can produce them at any point.

Do you see the pattern here?

With me included, there’s at least 4 lawsuits of Pinney not paying compensation/commissions that I know of.

What a terrible way to treat the agents who helped build their business.

Bottom Line

I have never talked negatively about any company or organization on this website or my podcast, but I’m forced to because everyone associates me with Pinney Insurance. And I truly apologize to everyone that this effects.

While Pinney had a good run from 2011-2014, they’re no longer a factor. There are many other ethical BGAs out there.

I can rattle off a lot more information that would deter you from ever doing business with Pinney Insurance, but I want to make sure I can back everything said here with hard evidence.

If you’re currently working with Pinney Insurance, I recommend using a different BGA. Don’t support an unethical BGA.

If you’re currently receiving overrides on their Elite level contracts, I’d talk to an attorney to make sure you’re covered when you eventually leave. They won’t pay your future overrides/commissions if you start writing outside of them (as I’ve experienced first hand) so start making an exit strategy.

If you’re considering using Pinney Insurance, look elsewhere. There are so many great BGA’s across the nation I’ve met with and talk to regularly. Honorable people who truly want to help agents grow their business and not sabotage it like they have a history of doing.

If you’re a telesales agent looking for the same back office support as Pinney, check out my BGA – DigitalBGA. We provide better contracts, support, technology and leads.

In our industry we sell a promise to pay on a piece of paper to protect loved ones, it’s too bad that Pinney Insurance doesn’t keep their promise.